- Which Term Plan is Better?

- Premium Payment Modes

- Add-on Advantages

Himanshu is a content marketer with 2 years of experience in the life insurance sector. His motto is to make life insurance topics simple and easy to understand yet one level deeper for our readers.

Reviewed By:

Sharan Gurve has spent over 9 years in the insurance and finance industries to gather end-to-end knowledge in health and term insurance. His in-house skill development programs and interactive workshops have worked wonders in our B2C domain.

Updated on Aug 07, 2023 4 min read

HLPP or Term Plan

If having a home is a need, a home loan is a necessity – at least in the age, we are living in. Having a shelter fulfills our basic physiological needs and gives us safety and security.

However, with the increasing property prices each day, it is becoming extremely difficult to fulfill this basic need. One way to battle this dilemma is availing of a home loan. However, life is not free of its uncertainties, and hence many lenders offer home loan protection plans to help an individual or his family to repay the loan in case of any unexpected occurrences.

However, many people would say that term plans offer the same protection, right? Let’s discuss this in detail and try to understand the nuances of the two plans.

What is HLPP?

HLPP is a risk-mitigating tool, under which the outstanding home loan amount will be covered if the owner of the house passes away unexpectedly. This plan offers protection to the family members of the borrowers from the burden of paying the remaining loan amount. The risk cover will be equal to the outstanding loan amount and will reduce as the loan reduces, which is called the reducing balance principle.

Based on the type of benefits that they provide, term plans are classified into the following types:

What is The Term Plan?

A term plan is a life insurance product, which provides financial coverage to the insured for a specific period covered by him, without any profit component. This plan provides financial compensation to the family of the insured in case of his unexpected passing away. These plans are basic and affordable, and a policyholder can take a larger cover at a lower premium.

Comparing HLPP & Term plan

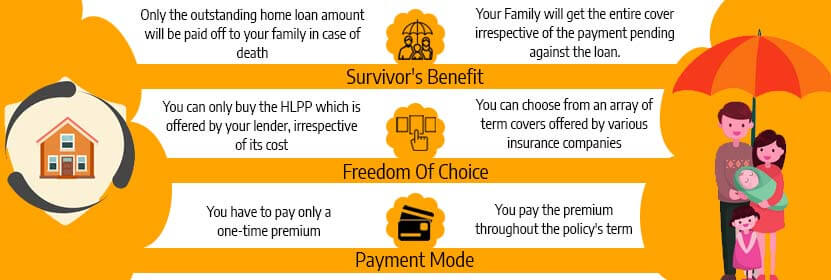

At the onset, both plans look similar and fulfill the same objective of providing a financial cover. Both the plans have one commonality – they don’t have maturity benefits, i.e. if the insured survives the policy term, he will not get any benefits. However, there are a few points that need to be considered while purchasing these plans.

Type of Cover

As the name suggests, an HLPP will only cover your home loan, and hence if the insured dies, the amount can only be used for clearing his outstanding loan amount. On the other hand, in the case of term plans, the death benefit can be used for any of the family and is not restricted to any liabilities of the insured. In the case of HLPP, there is no option for portability and the plan cannot be switched to another lender.

Premium

Most HLPP plans require one-time premium payment, while term plans require a schedule of small premium payments. Due to this, the premium for HLPP is higher than the premiums for term plans, thus making the latter more affordable.

Another advantage of term insurance is that the cover and the premium can be modified during the policy term. However, since the premium for HLPP is already paid, the cover cannot be modified. Hence, if an individual increase his home loan tenure, the policy tenure will remain the same, thus leaving the extended home loan tenure exposed to risks. In case the individual decides to foreclose the HLPP, the one-time premium amount will not be refunded.

Life Cover

A term plan provides life cover to the insured and his family, irrespective of the number of liabilities owed. If the insured dies, the family is eligible to get the sum assured, and can then use it for clearing all the liabilities and caring for their family needs. However, an HLPP is directly related to the sanctioned home loan amount, and changes as per the loan amount. If the insured pays off the loan, or the amount gets reduced over some time of the loan, the risk cover reduces and becomes zero (once the loan is fully paid). Hence, families who want a life cover will prefer term plans.

Add-On Benefits

Both term plans and HLPP come with add-on benefits that cover terminal illnesses, unemployment, disabilities, etc. Many plans also provide cover for diseases such as cancer, cardiac issues, etc. However, HLPP also provides cover for the first 3-6 months of home loan EMI payments, which makes them preferable for home loan buyers. However, the cost of adding these covers will differ, and hence a careful comparison must be done before availing of these add-on benefits.

Conclusion

HLPP is a preferred choice for lenders as it keeps their disbursed amount secured. Due to this reason, most lenders push HLPP to their customers even though it is not a compulsory option. Also, with an HLPP, the lender’s chances of incurring bad debts are reduced significantly. When applying for home loans, lenders often assess the creditworthiness of the individual, and hence opting for an HLPP often increases the chances of loan sanction or approval.

However, for borrowers, a best term plan is more suitable, as it keeps all their liabilities and needs of the family secured. If an individual has an adequate term plan which offers him tax benefits as well, then he may not need an additional HLPP. However, if the existing term plan is not adequate and the insured wants to protect his family from a major financial risk, then it will be beneficial to go for an HLPP as well. It is important to remember that a person’s term insurance cover should be 10 times his current income. Based on this premise, every individual should decide if he needs another insurance cover.

Other Term Insurance Companies

Share your Valuable Feedback

4.6

Rated by 859 customers

Was the Information Helpful?

Select Your Rating

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Written By: Himanshu Kumar

Himanshu is a seasoned content writer specializing in keeping readers engaged with the insurance industry, term and life insurance developments, etc. With an experience of 2 years in insurance and HR tech, Himanshu simplifies the insurance information and it is completely visible in his content pieces. He believes in making the content understandable to any common man.

4493-1741698074.png)

4509-1741341976.png)

Do you have any thoughts you’d like to share?